The UK’s largest business group has laid bare the impact of spiralling utility and fuel bills on small businesses ahead of the Chancellor’s Spring Statement this week.

Illustrative analysis from the Federation of Small Businesses (FSB) shows an electricity and gas bill increasing from £4,724.73 to £11,589.89 (+145%) and from £1,345.07 to £4,815.36 (+258%) respectively for a small business in London with a commercial premises between February 2021 and February 2022.

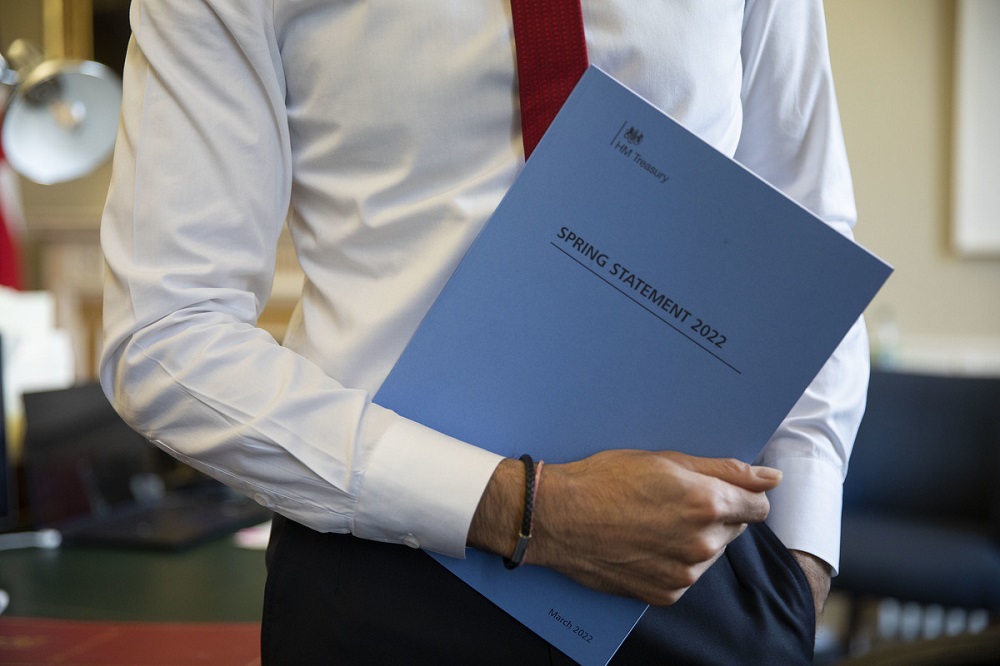

A £9.1billion Energy Bills Rebate will be announced in the Spring Budget as the country battles escalating costs of living.

The National Living Wage will also increase to £9.50 per hour from April, but FSB National Chair Martin McTague says the UK is at a critical moment.

McTague said: “Unless the Government intervenes, soaring fuel and utility bills will spell the end for many of the quarter of a million firms that say they are on the brink of collapse.

NOW READ: Crypto Matters: expert guidance on cryptocurrency

“When small businesses go under, that sends shockwaves through local communities in the form of lost jobs, reduced investment and damaged consumer confidence.

“Whether it’s the care home bracing for an even higher tax bill because of the so-called health and social care levy, the electrician facing higher and higher charges to fill up to complete urgent jobs, or the restaurant which, after two years of trading restrictions, is trying to rebound as energy and food prices rocket, small firms right across the piece are in urgent need of support.

“As things stand, firms have no choice but to raise prices to cover overheads – by tackling the cost-of-doing-business crisis, the Chancellor can help end the cost-of-living crisis.”

Rishi Sunak is set to say that freedom and democracy remain the best route to peace, prosperity, and happiness, with people across the UK facing growing pressures exacerbated by the war in Ukraine.

McTague said: “He can’t control the wholesale cost of gas and oil, but he can control tax policy.

“Cutting fuel duty, assisting micro-businesses with energy bills, increasing the Employment Allowance to £5,000 and reforming business rates to take more small firms out of the system in levelling up target areas – all measures that would help small businesses to keep their heads above water, and support the millions they employ.”

For the latest headlines from the City of London and beyond, follow City Matters on Twitter, Instagram and LinkedIn.